Payday Loan Software Screens

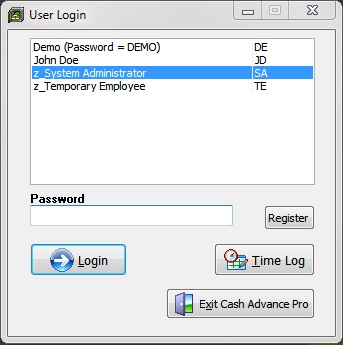

In order to use this Payday Loan Software, users must identify themselves by logging in with their own personal password:

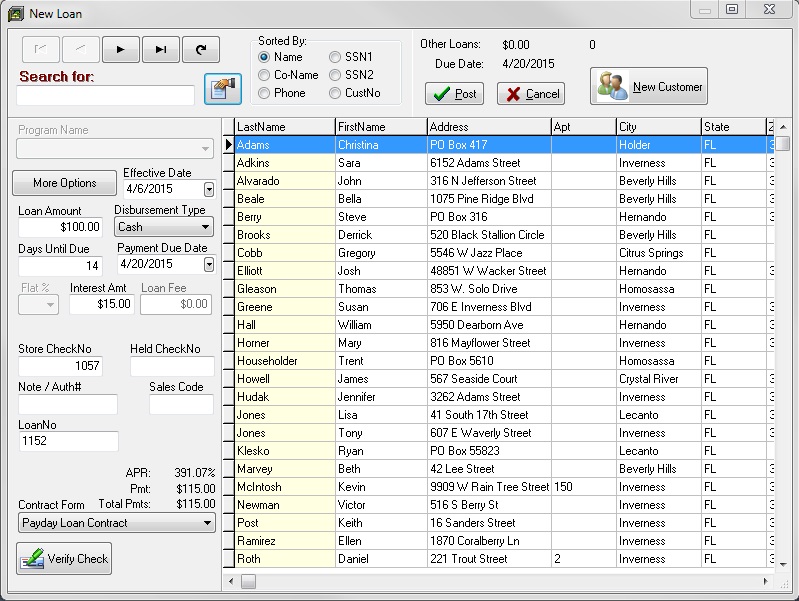

New loans are created in this Payday Loan Software by selecting a customer and entering the appropriate loan amount and term. The system automatically increments the Store Check number for check loans. Cash loans also may be given.

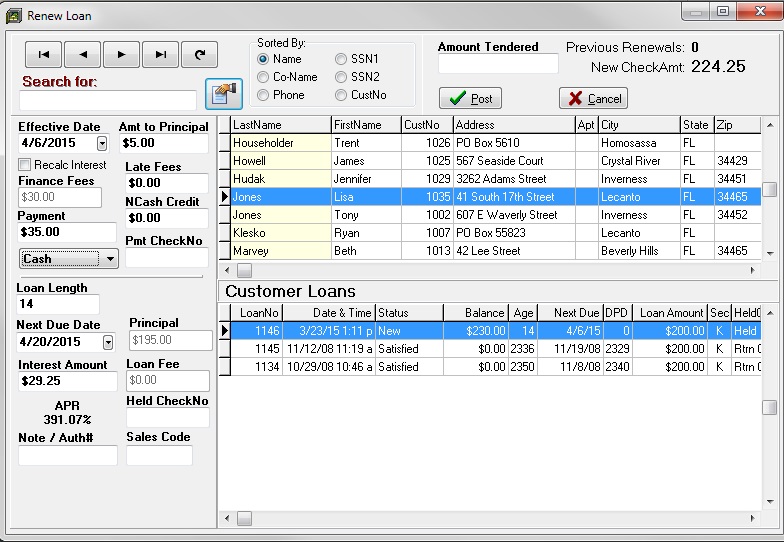

Loans are renewed in Cash Advance Pro by selecting the customer and the loan to renew, then entering the correct parameters for closing the existing loan and opening a new loan.

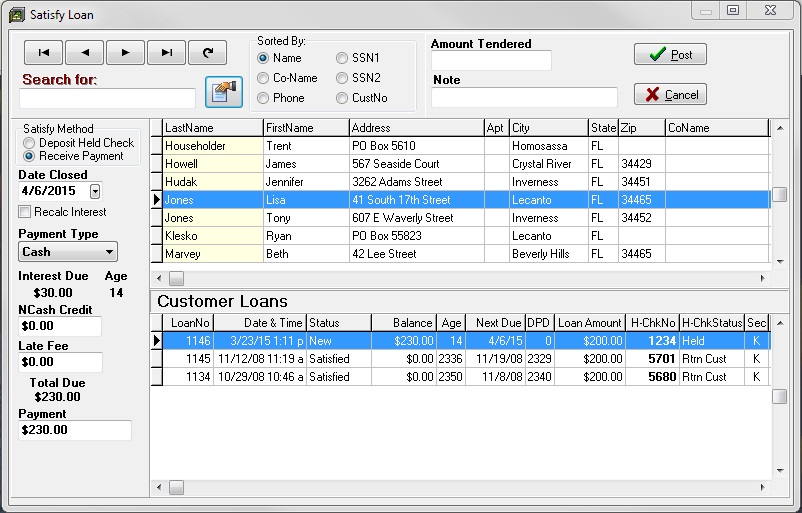

Loans are satisfied in Cash Advance Pro by selecting the customer and loan, then entering the correct closing parameters. If the satisfy method is “Deposit Held Check,” then the check being held is shown to be deposited and the drawer expects it to be included in the next bank deposit. If the satisfy method is “Receive Cash Pmt,” then the check is reflected as being returned to the customer and cash is added to the cash drawer ready for the next bank deposit.

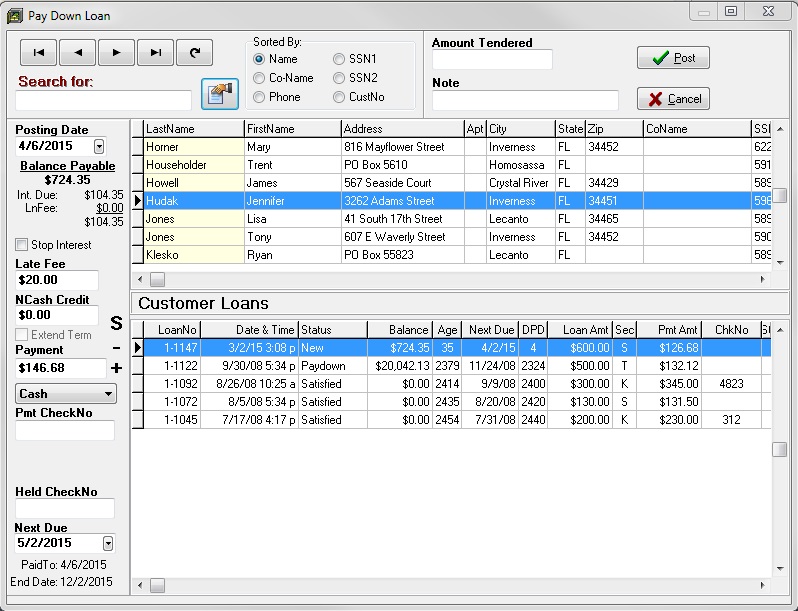

Loans in this Payday Loan Software may be put in a special pay down status. This status allows all payments to go toward paying off whatever is left on the contract. This screen also may be used to credit satisfied loans and charged-off loans which still show a balance.

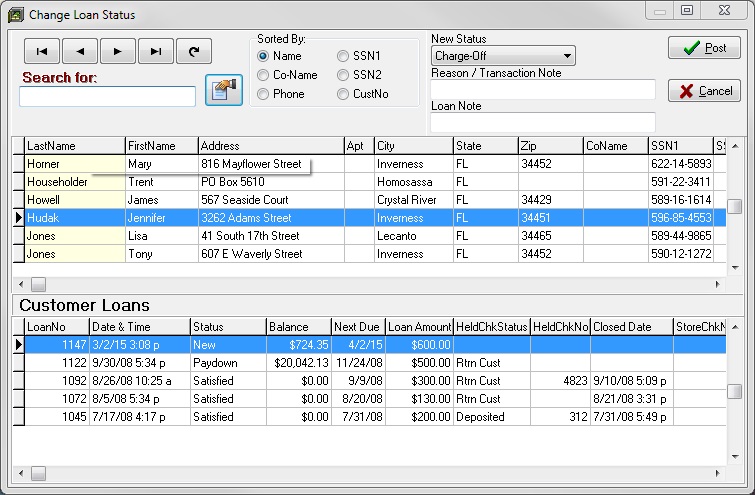

Loan Status may be changed in Cash Advance Pro by selecting the customer and loan in the following screen. Choose a New Status from the drop-down list: Charge-Off, Voided, Legal, Repossession, Bankruptcy, Difficult, Hold, or Previous Status. A descriptive reason for the status change may be entered as well. This enables this Payday Loan Software to separate this loan from others and to keep them off reports (depending upon which status is selected) which your collectors regularly work. It also enables reports to be generated for special collection purposes. The balance still owed continues to be maintained in the records so that it may be collected at a later date (depending upon which status is selected). The operating summary records a summary of how many and the amount of charged-off loans.

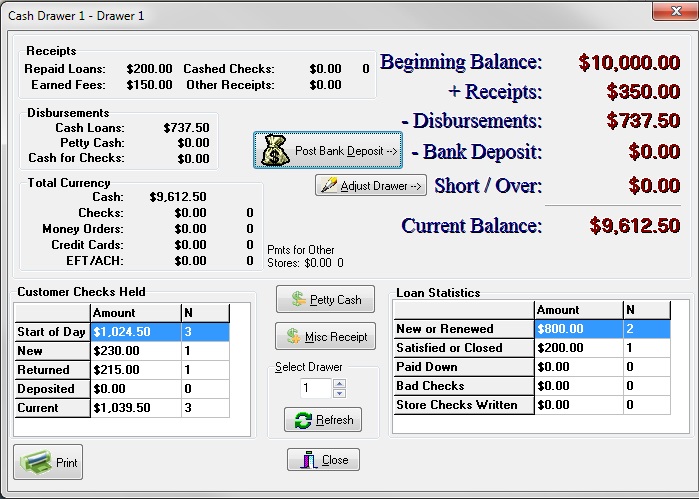

Transactions in this Payday Loan Software update the cash drawer so you always know what has been going on in the store at a glance. The beginning balance, receipts, disbursements of money from the drawer, etc. are all reflected here. The total amount of cash, checks, and money orders are clearly separated. The loan statistics and changes in held checks are all for the current day only. The operating summary created at the end of each day records similar information for long term analysis.

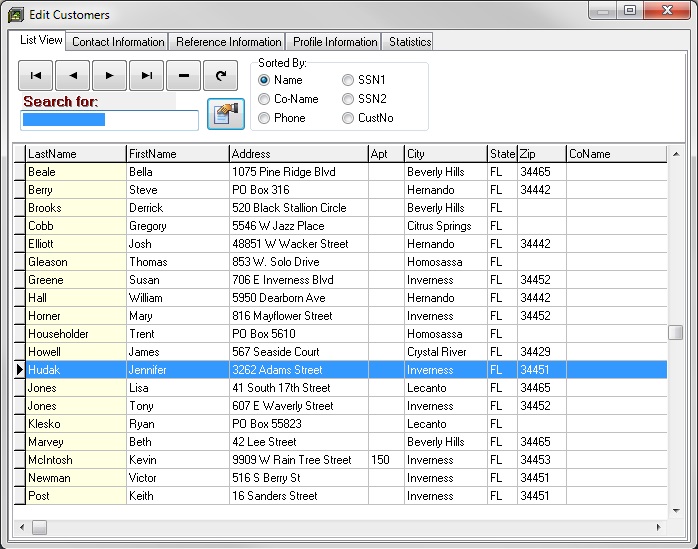

The edit customer screen in this Payday Loan Software is conveniently separated into pages, something familiar to users of Quick Books. The first page shows a list view of customers making it easy to select the customer you are interested in. As with the other transaction screens, the order of the customers may be changed to order it by name, co-signer name, phone number, social security number, social security number of the co-signer, or by customer number. Any of these fields may be searched through or browsed. Much more customer information can be seen by scrolling the window to the right.

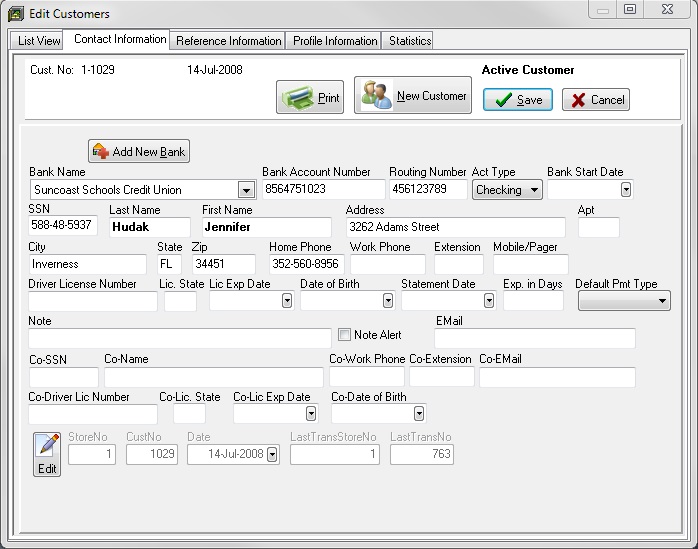

By clicking on a tab, the information for a particular customer may be viewed and edited in a form. Below is the contact information page accessed simply by clicking the tab at the top of the form. If the user checks the Note Alert check box, then other users will be notified of the important note whenever they access this account for a transaction.

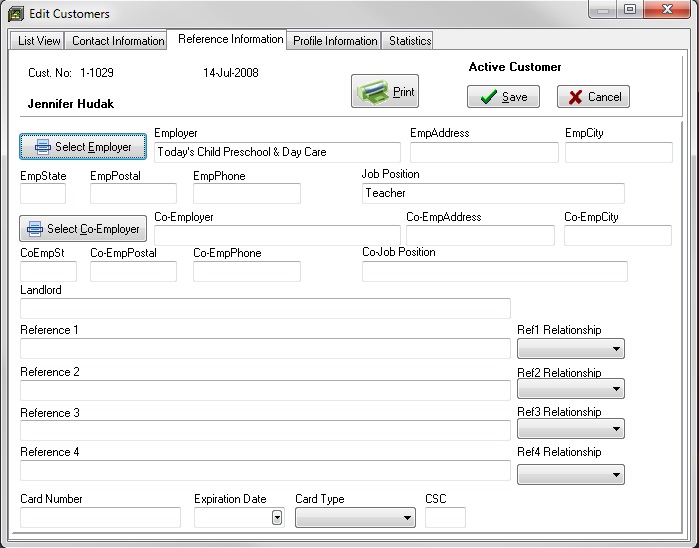

The following page shows reference information for the customer.

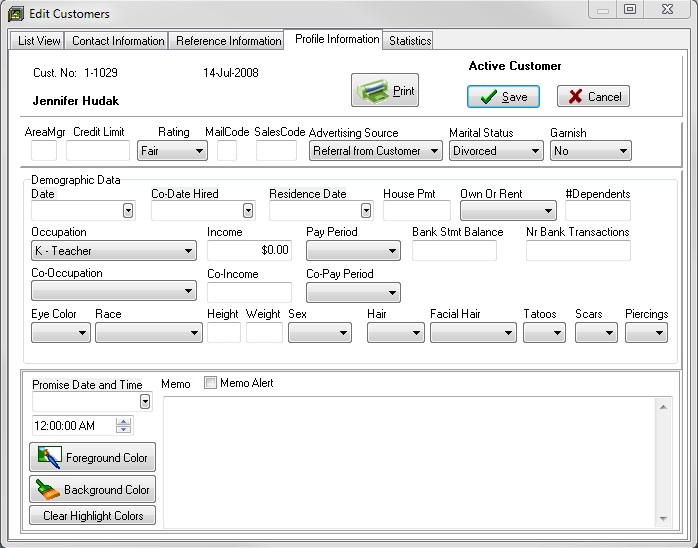

The following page shows information which profiles the customer. This information can be used in marketing analysis. There is also a memo field which is like a scratch pad or notebook area where any comments may be entered. A promise date and time also may be entered indicating when the customer plans to settle his account.

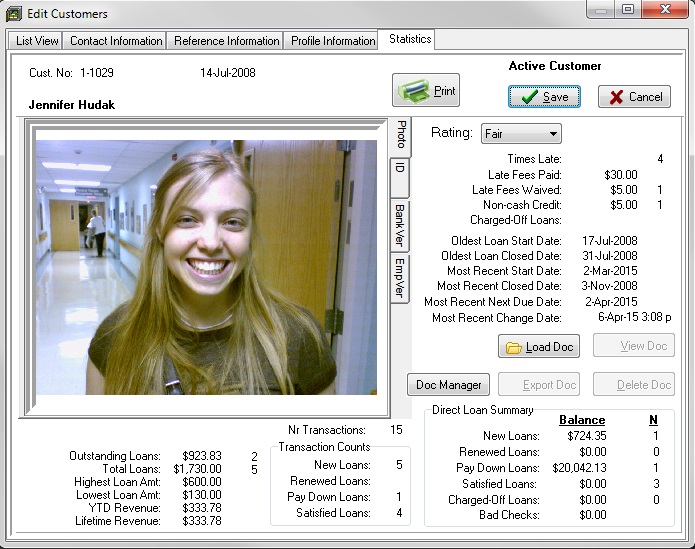

This page shows statistics about this customer, such as how many loans they have done, the amount of those loans, and the amount of outstanding loans. The number of times the customer has been late, the number of times and amount of late fee waivers, the number of times and amount of non-cash credit given, are all conveniently displayed on this page. You can even see how much money you have earned by loaning money to this customer. Also available on this page is the ability to attach images and documents related to the selected customer.

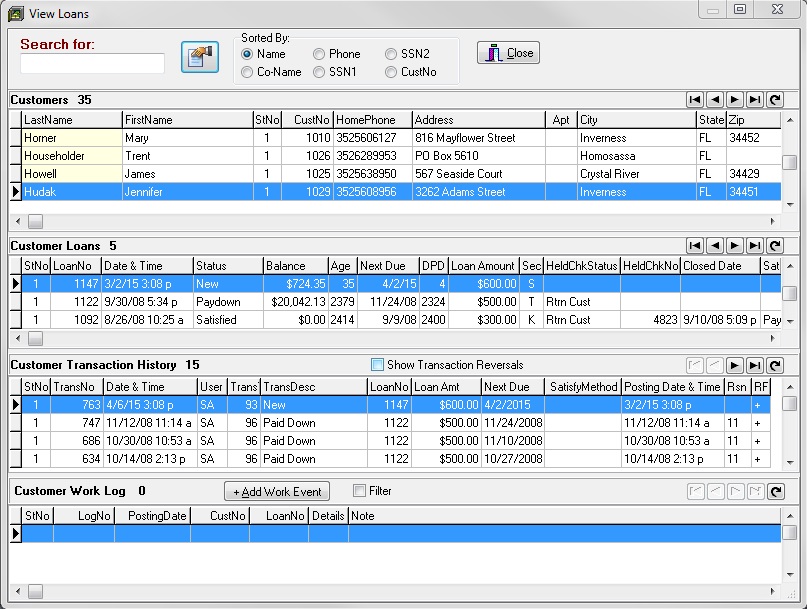

A history of the customer’s loans and transactions may be viewed easily at the following screen.

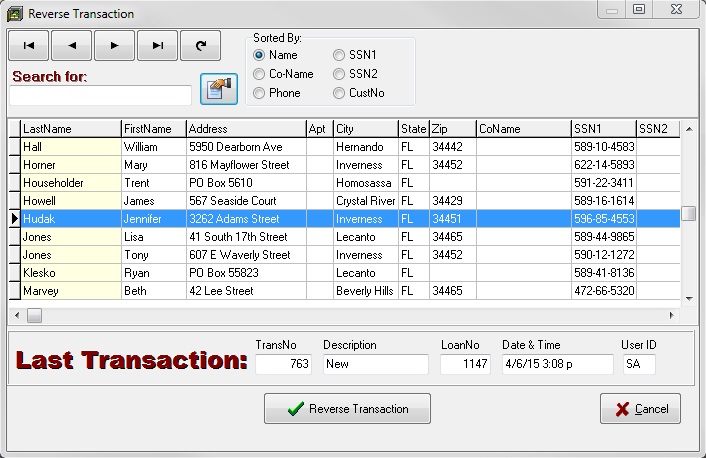

Mistakes are easily corrected in Cash Advance Pro during the course of a business day. Transactions are reversed during the current business day by simply selecting the customer. The last transaction done by the customer is shown. Clicking on the “Reverse Transaction” button reverses what had been done. It is basically like an undo button in editing programs. If necessary, you may continue to reverse previous transactions done by this customer.

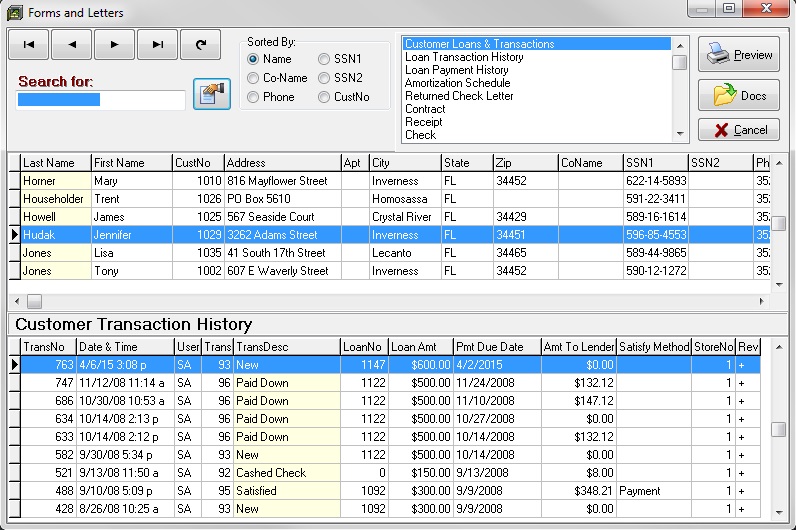

The following screen shows how forms and letters for a customer may be printed. Reprints of contracts, receipts, and checks may be done here also.

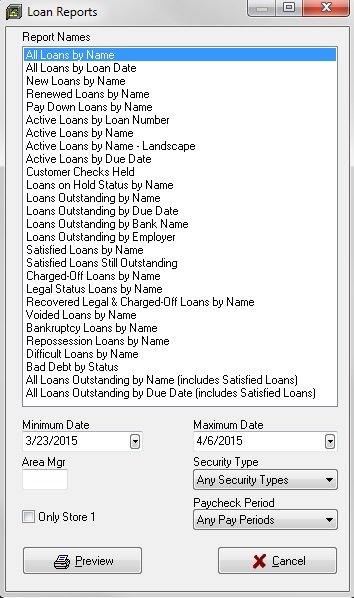

The following screen shows how loan reports are selected and processed. None of the reports in the Payday Loan Software are hard coded into the program. A report writer configures the reports, so future custom reports are a cinch to create without updating the program.

The following shows the kind of information reported in the operating summary.